Developing a Third-Party Risk Management Policy: Best Practice Guide

Third-party relationships are essential but also can introduce significant risks that impact your organization’s operations, data security, and regulatory compliance. A robust third-party risk management (TPRM) policy sets the foundation for identifying, monitoring, and mitigating these risks. This blog explains the importance of a well-defined TPRM policy, breaking down its key components and providing best practice recommendations for policy development and implementation.

What Is a Third-Party Risk Management Policy?

A third-party risk management (TPRM) policy is a set of documented guidelines for how organizations handle risks from vendors, suppliers, and partners. It helps them establish procedures to assess, monitor, mitigate, and report these risks. These policies provide a foundation for building a robust and effective TPRM program.

Why TPRM Policies Are Important

Numerous organizations have faced major disruptions and legal ramifications due to breaches by third, fourth, or even Nth parties. Weak TPRM practices can pose an existential threat to your company’s data and supply chain. Third-party risk management policies outline clear, standardized, and actionable procedures to support stronger risk management practices. A well-defined process for managing and mitigating vendor risk is a critical measure for protecting your operations from today’s threat landscape.

As third-party risks grow more complex and widespread, organizations need policies to minimize vendor-related risks and procedures to manage incidents when they arise. With vast vendor networks and third-party relationships extending across multiple departments, risk management policies must be practical, aligned with organizational objectives, and applicable across various risk types and stages of the third-party lifecycle.

Key Components of Third-Party Vendor Risk Management Policies

A clear set of policies strengthens your third-party risk management practices and prioritizes risk throughout due diligence and the vendor lifecycle. A comprehensive TPRM policy should address the following:

- Purpose – State the aim for establishing or restructuring a third-party risk management program.

- Roles & Responsibilities—Define your key stakeholders, decision-makers, and those responsible for implementing and managing vendor risk activities.

- Compliance Requirements – Make sure your policies address key third-party risk compliance regulations and the regulatory landscape of your vendor network.

- Risk Tolerance or Appetite – Define your organization’s acceptable and non-acceptable level of risk. Consider including a Third-Party Risk Appetite Statement as a foundational aspect of TPRM policies. Read our guide on this measure here.

- Risk Management Processes and Procedures – Outline the key elements of your third-party risk management program, such as:

- Risk identification

- Due diligence and assessment

- Risk evaluation

- Contract management

- Continuous monitoring

- Incident management

- Termination procedures

Addressing Compliance Requirements in Third-Party Risk Management Policies

Review your internal compliance measures and regulatory requirements before you begin writing your third-party risk management policies. When drafting your policies, consider relevant regional regulations such as CCPA and GDPR, internationally accepted frameworks such as NIST and ISO standards, and industry-specific regulations such as HIPAA and PCI DSS.

Regulatory requirements to consider incorporating into your TPRM policies may include:

California Consumer Privacy Act (CCPA): Regulates the collection and sale of consumer data to protect California residents' sensitive personal information and give them control over its use.

Cloud Security Alliance CAIQ: An industry-standard questionnaire for documenting security controls, aiding in security evaluations of IaaS, PaaS, SaaS, and other cloud providers.

Cybersecurity Maturity Model Certification (CMMC): A U.S. Department of Defense framework to secure the defense industrial base from cyberattacks and ensure a resilient national defense supply chain.

European Banking Authority (EBA) Guidelines on Outsourcing Arrangements: Provides specific governance and supervision requirements for outsourcing in the European banking sector.

FCA FG 16/5: UK guidance to help financial firms oversee all stages of outsourcing arrangements.

FFIEC IT Exam Handbook: Sets uniform principles and standards for federal examination of financial institutions, including IT topics.

General Data Protection Regulation (GDPR): Regulates the use, movement, and protection of personal data on EU citizens, applicable to organizations worldwide that handle EU data.

HIPAA: Ensures sensitive health information (PHI) is protected and not disclosed without patient consent.

ISO Standards: These include ISO 27001, 27002, and 27036-2, which set international standards for managing and improving information security.

Interagency Guidance on Third-Party Relationships: U.S. guidance from federal banking agencies to unify risk management for vendor and supplier relationships in banking.

NERC CIP: Cybersecurity standards for electric utilities to maintain the reliability of the bulk electric system (BES).

NIST: Provides publications like NIST 800-53, NIST 800-161, and the Cybersecurity Framework (CSF) to help organizations manage supply chain risk.

NY SHIELD Act: Requires organizations handling New York residents' personal data to improve cybersecurity and breach notification procedures.

NY CRR 500: Sets cybersecurity requirements for financial services in New York, focusing on customer data protection and IT system integrity.

PCI DSS: Global standard for securing cardholder data, applied to all entities that store, process, or transmit it.

SOC 2: Industry standard framework for demonstrating confidentiality, integrity, and availability of systems and data. SOC 2 audits are used for internal control reporting and reporting safeguards over infrastructure, software, people, procedures, and data.

Understand Your Regulatory Landscape

When designing policies and procedures, consider broad compliance requirements affecting business operations. For example, if your company handles protected health information (PHI), your third-party risk management policies should specify how and when to share this information with other organizations. Under HIPAA, third parties—and any further parties involved—must apply the same safeguards as your organization when handling PHI. Non-compliance can lead to substantial fines for your organization and any business partners.

Many information security requirements strictly limit the types of data you can share with third parties. Be sure to consider requirements specific to individual business units as well. For example, GDPR imposes strict rules on storing, protecting, and transferring data from European nationals. In many cases, only one department may handle European data. Rather than relying on industry assumptions, assess the types and volumes of data collected across your organization to determine precise compliance needs.

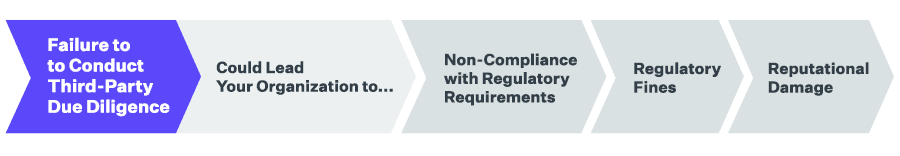

Clearly define in your policies what information you share with third parties, when you share it, and the protocols to protect it. Requiring third-party organizations that handle sensitive data to comply with standards like SOC 2 or HIPAA can strengthen security. Without these safeguards, you risk non-compliance with regulatory requirements and potential reputational damage if a third-party data breach occurs. Always conduct thorough due diligence before sharing sensitive information with any third party.

Base Your Third-Party Risk Management Policies on Widely Accepted Standards

Fortunately, you don’t need to develop all the controls yourself. When planning your third-party risk management program, you can borrow from widely accepted third-party risk management frameworks such as NIST SP 800-161 or Shared Assessments TPRM Framework.

Pre-built frameworks offer excellent guidance on the controls to include in your third-party risk management policies. Third-party risk can take various forms. By adhering to a battle-tested framework, you can ensure that your vendor risk management is comprehensive.

In addition, you can utilize other frameworks, such as NIST CSF 2.0 and ISO 27036, to help you design your vendor risk assessment questionnaires. Questionnaires are essential to the vendor risk management lifecycle and should be mandatory for all new service providers. Third-party risk management policies should specify how and when business units must administer security questionnaires and define acceptable levels of residual risk.

We recommend reviewing Shared Assessments and NIST 800-161 to help you plan your program's look and the types of controls worth including. You can then pick specific controls from standard information security frameworks. Often, U.S.-based organizations rely on NIST, while companies in Europe, Asia, and Africa tend to choose ISO.

Require Standardized Third-Party Documentation

Ensure your organization operates from a standard documentation set when dealing with third-party relationships. Non-disclosure agreements, third-party risk questionnaires, and service level agreements (SLAs) should be uniform throughout the procurement lifecycle. Standardization is particularly important when creating your organization's vendor risk assessment questionnaire. Without a standardized vendor evaluation process, you can’t compare different vendors based on the level of risk they pose to your organization.

Third-party risk policies should require evaluating third-party vendors based on their risk level and mandate remediation for high-risk vendors before they join the supply chain. Continuously monitor vendors for cybersecurity, operational, and compliance risks throughout the business relationship. Just because an organization was low-risk at the time of onboarding does not mean it will remain so.

Consider 4th Parties in Your Risk Policies

Larger businesses with extensive networks of third-party contractors are especially vulnerable to security risks. When a third party subcontracts a fourth party, weak security practices at any level can expose your organization’s data to malicious actors. Criminal groups often exploit vulnerabilities in these extended networks, working their way through subcontractors to access sensitive information.

To mitigate these risks, contracts with suppliers must include provisions for fourth parties. If a third-party vendor is permitted to subcontract, the SLA should require the fourth party to follow the same cybersecurity guidelines as the primary organization. Regulators can still hold a corporation liable and impose fines if a fourth party causes a data leak, even if the corporation was unaware of it.

Vendor Risk Policy Checklist

Here are some recommended controls to include in your third-party risk management policy:

General

Require vendors to complete a standardized risk assessment questionnaire before onboarding.

Use profiling and tiering to establish a consistent vendor assessment methodology.

Score and track inherent and residual risks to identify vendors posing the greatest risk.

Monitor vendors continuously after onboarding.

Reevaluate vendors periodically to assess changes in risk level.

Automate communications with workflows and ticketing.

Use flexible risk weightings to specify the importance of individual risks.

Compliance

Evaluate third-party vendors for compliance issues before onboarding.

Document and retain records of all data shared with third parties.

Require third parties holding organizational data to correct non-compliant practices before accessing sensitive information.

Monitor business developments across extensive sources to identify regulatory, reputational, or legal risks.

Recommended: Require vendors to obtain information security certifications before onboarding.

Information Security

Continuously monitor vendors for cybersecurity risks throughout the contract period.

Contractually require vendors to notify the organization of any security breach or suspected breach.

Review vendor security policies thoroughly and cross-check against questionnaire responses.

Ensure vendors delete all organizational data upon contract termination.

Include clear data protection clauses in all third-party contracts.

Trigger actions such as notifications, tasks, risk score adjustments, and accelerated mitigation.

Transform vendor cyber and business event data into actionable risks for real-time visibility.

Maintain a unified risk register to correlate cyber and business risks with assessment results, validating vendor control data.

Utilize deep/dark web cyber monitoring for real-time risk intelligence.

Operations

Require vendors to update on key personnel, financials, and other factors impacting the supply chain.

Have each department submit vendor data to a central repository.

High-risk vendors are required to remediate risks to acceptable levels to maintain engagement.

Contractually obligate third-party vendors to follow offboarding procedures, including returning equipment and badges and deleting sensitive information.

Consider fourth parties and beyond when drafting SLAs and other critical contracts.

Third-Party Risk Management Policies and Practices Next Steps

By adopting third-party risk control strategies and procedures, your organization can navigate the complexities of vendor risk, support stronger security practices, and maintain compliance across all stages of the vendor lifecycle. Leverage a dedicated TPRM solution to streamline and automate these critical processes.

Discover how you can simplify third-party risk management with Prevalent. Schedule a strategy call or demo today.

-

The Top 7 TPRM Predictions for 2025

2025 promises to be a consequential year for third-party risk management. Read our top TPRM predictions...

12/12/2024

-

Vendor Offboarding: A Checklist for Reducing Risk and Simplifying the...

Follow these 7 steps for more secure and efficient offboarding when third-party relationships are terminated.

10/17/2024

-

Third-Party Risk Management: The Definitive Guide

Third-Party Risk Management (TPRM) has advanced from being an annual checklist exercise to a critical daily...

10/07/2024

-

Ready for a demo?

- Schedule a free personalized solution demonstration to see if Prevalent is a fit for you.

- Request a Demo